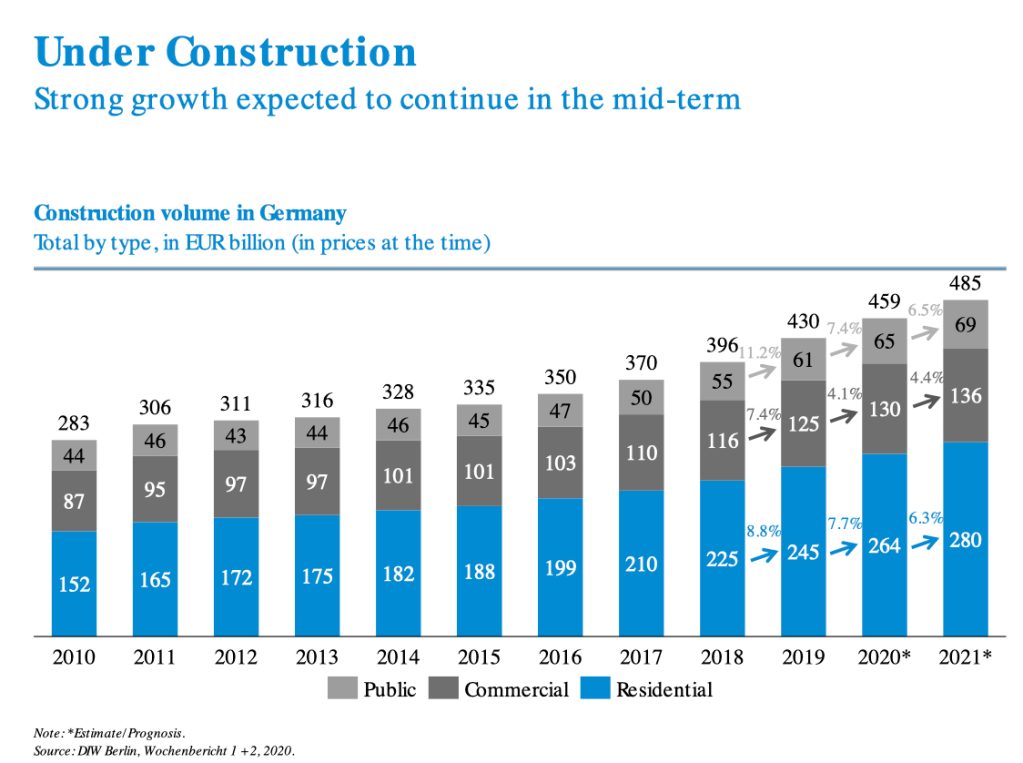

Burgos, October 19, 2023.- Germany is Europe’s leading construction market and home to the continent’s largest building stock. A number of drivers have led to a boom in German construction investment and this is largely expected to continue in the foreseeable future. As part of its ongoing transition to a sustainable energy system, Germany aims to have an almost climate-neutral building stock by 2050. Three quarters of buildings in Germany were built before 1980, making the renovation of existing stock key to meeting energy efficiency targets.

However, the German government has announced that it will shelve proposed building regulations as part of a €45 billion (US$47 billion) relief package to prop up the country’s ailing construction industry.

Germany construction firms have been struggling with inflation and higher interest rates. Berlin will make €18 billion available until 2027 for affordable housing, with the rest of the funding coming from federal states and municipalities.

“We must massively expand activities in housing construction,” Chancellor Olaf Scholz told a press conference ahead of a meeting with industry leaders to discuss the housing crisis in Europe’s biggest economy. “We need more affordable housing.”

The government has put on indefinite hold plans to require more stringent building insulation standards, an effort to help prop up the ailing industry. Their abolition has been a top demand of industry, which says the measures are too expensive.

In addition, the government also said it would oppose new proposed European Union legislation that could require millions of buildings to be upgraded using methods such as insulation or efficient heating systems.

Opponents of the law fear it imposes too high a burden on the government and homeowners. For years, low interest rates helped fuel a German property boom but a rapid rise put an end to the run, tipping a string of developers into insolvency as deals froze and prices fell. German housing prices fell by the most since records began in the second quarter, government data showed on Friday.

“The federal government has now finally recognized how serious the situation on the housing market is,” head of the Central Association of the German Construction Industry, Felix Pakleppa, told Reuters. “It is crucial that the federal, state and local governments implement this promptly.”

The government will also promote the conversion of empty offices and shops into flats with €480 million over the next two years, said construction minister Klara Geywitz, which could be used to build 235,000 new apartments. “With our new funding, more people will be able to buy a house, an existing or a new one,” she said.

Other measures included extending a so-called “speed bonus” to support climate-friendly heating installations and raising the subsidy amount to 25% from 20% of the cost of renovating a heating system, the minister said. The sector needs liquidity, according to the German Construction Industry Association.

The response of German construction entrepreneurs

Business groups and economists have called on the German government to intervene to help the crisis-hit construction industry, as a wave of insolvencies claims a growing number of high-profile property developers.

Builders are facing a perfect storm of rising interest rates, more expensive construction materials, a dire shortage of skilled workers and slowing demand for new developments that has led to financing problems across the industry.

“We are at the end of a 10-15 year property boom,” said Moritz Schularick, head of the Kiel Institute for the World Economy in Germany. “The financial cycle is now such that every day another property developer is going bust . . . The old funding models are no longer sustainable.”

A number of developers have filed for insolvency in the past few weeks, among them three Düsseldorf-based firms Gerch, Centrum Group and Development Partner, as well as Euroboden of Munich and Project Immobilien Gruppe of Nuremberg.

Meanwhile, big landlords such as Vonovia and Aroundtown have announced big writedowns of their property portfolios.

“With interest rates rising so quickly, a lot of projects are just not profitable any more,” said Clemens Fuest, head of the Ifo institute in Munich, a think-tank. “Demand in residential housing has just collapsed.”

Some experts think the situation could deteriorate. “With developers that bet on rising prices I expect to see an increasing number of insolvencies in the market,” said Dirk Salewski, head of BFW, the German association of independent real estate and housing companies. “The most highly-indebted are the most vulnerable.”

The crisis in the housing sector is a problem for Olaf Scholz, chancellor, who came to office vowing to build 400,000 flats a year. Just 295,300 dwellings were built last year and industry executives expect the numbers for this year and next to be even lower.

Ministers have adopted measures to help the sector. At its two-day retreat in Meseberg palace last week, Scholz’s cabinet passed a €7bn package of corporate tax relief that included new rules on the depreciation of investment costs for builders. Building minister Klara Geywitz said they should help “really rev up” housing construction in Germany.

But Salewski of BFW called the rule change a “drop in the ocean”. “It doesn’t solve the main problem, which is a lack of liquidity,” said Tim-Oliver Müller, head of HDB, the central federation of the German construction industry.

Müller called for more low-interest loans for homebuyers, a relaxation of tough energy-efficiency standards in new buildings and investment allowances for publicly-owned housing associations to help them complete stalled construction projects. He said he hoped Scholz would adopt some of these suggestions at a planned construction summit in the chancellery later this month.

Construction, which accounts for 12 per cent of Germany’s gross domestic product and employs nearly 1mn people, is seen as a key pillar of the German economy. But it is stuck in a deep recession.

Only 135,200 flats were permitted in the first six months of this year, 27 per cent or 50,600 fewer than in the same period last year. According to Ifo, in July 40.3 per cent of construction companies complained about a shortage of orders. Some 18.9 per cent said projects had been cancelled and 10.5 per cent said they had experienced financial difficulties.

Schularick called on the government to intervene in the sector, saying it should usher in a big housing construction programme which would have the added advantage of stimulating Germany’s weak economy.

“Private developers are not going to be building any housing in the next couple of years, so the state, the municipalities, the public sector should be going in there and financing construction,” he said, adding that Germany’s many publicly-owned housing associations could be used to drive the programme. “We urgently need new flats, not just as a short-term fiscal stimulus but as a long-to-medium term growth programme,” he said.

This Analysis has been built with the documentation published by:

Financial Times

DIW Berlin

Construction Europe

Leave a comment